Due date to file Income Tax return has been provided under section 139 of the Income Tax Act. Further section 139 of the Income tax al...

Due date to file Income Tax return has been provided under section 139 of the Income Tax Act. Further section 139 of the Income tax also provide the person who are required to file the compulsory return of Income tax .It is mandatory for every taxpayer to communicate the details of his income to the Income-tax Department. These details are to be furnished in the prescribed form known as return of income. Mode of Filing and correct form has been prescribed under rule 12 of the Income Tax rules (Rule 12 has been amended vide notification dated 30.03.2017 .

The provisions relating to filing of return of income depend upon the status of the taxpayer. The position in this regard is given below:

Before explaining the due date to file Income Tax return for Assessment year 2017-18 (Financial year 2016-17) ,we have provided the persons who are required to file Income tax return.

Person required to file the return of income :

- [message]

- In the case of an Individual/HUF/AOP/BOI/Artificial Juridical Person:

- Every individual/HUF/AOP/BOI/artificial juridical person has to file the return of income if his total income (including income of any other person in respect of which he is assessable) without giving effect to the provisions of section 10(38), 10A, 10B or 10BA or Chapter VIA (i.e., deduction under section 80C to 80U), exceeds the maximum amount which is not chargeable to tax i.e. exceeds the exemption limit.

[post_ads]

Update : Due date for sr no 2,3,4 has been extended from

30.10.2017 to 07.11.2017

Maximum amount which is not chargeable under the Income Tax act or Exemption Limit for various person are as under

Example: 1: Suppose An Individual (age less than 60 years) having Taxable salary Income of Rs 3,70,000 and claim a deduction of Rs 1,50.000 under Section 80C (Chapter IV) and net Taxable income of 2,20,000 is required to file Income tax return as his income before deduction of chapter VI(80C in this case)(in present case Rs 370000) is more than maximum amount which is not chargeable under Income Tax Act ie Rs 2,50,000 for Ay 2017-18.

So if your Gross Total income before deductions is less than Rs 250000/- for assessment year 2017-18 and your age is less than 60 then no need to file income tax return(subject to other condition applicable for foreign income and bank accounts) .

Example :2 Suppose an individual (age less than 60 years),during fy 2016-17 ay 2017-18 having Income of Rs 4 Lakh from long term capital gain from shares sale exempted under section 10(38) ,is required to file Income tax return as income before exemption u/s 10(38) is more than maximum maximum amount which is not chargeable under Income Tax Act ie Rs 2,50,000 for Ay 2017-18.

[post_ads_2]

Update : Due date for sr no 2,3,4 has been extended from

30.10.2017 to 07.11.2017

- For very senior citizen (age 80 or more) :Rs 500000

- For Senior citizen (age 60-80) :Rs 300000

- For others (age less than 60) :Rs 250000

Example: 1: Suppose An Individual (age less than 60 years) having Taxable salary Income of Rs 3,70,000 and claim a deduction of Rs 1,50.000 under Section 80C (Chapter IV) and net Taxable income of 2,20,000 is required to file Income tax return as his income before deduction of chapter VI(80C in this case)(in present case Rs 370000) is more than maximum amount which is not chargeable under Income Tax Act ie Rs 2,50,000 for Ay 2017-18.

So if your Gross Total income before deductions is less than Rs 250000/- for assessment year 2017-18 and your age is less than 60 then no need to file income tax return(subject to other condition applicable for foreign income and bank accounts) .

Example :2 Suppose an individual (age less than 60 years),during fy 2016-17 ay 2017-18 having Income of Rs 4 Lakh from long term capital gain from shares sale exempted under section 10(38) ,is required to file Income tax return as income before exemption u/s 10(38) is more than maximum maximum amount which is not chargeable under Income Tax Act ie Rs 2,50,000 for Ay 2017-18.

[post_ads_2]

- [message]

- In the case of companies:

- Every person, being a company, has to file its return of income compulsorily, irrespective of its income being profit or loss. In other words, it is mandatory for every company to file the return of income irrespective of its income or loss.

- [message]

- In the case of partnership firm

- Every person, being a partnership firm (including Limited Liability Partnership), has to file its return of income compulsorily, irrespective of its income being profit or loss. In other words, it is mandatory for every partnership firm to file the return of income irrespective of its income or loss.

- [message]

- In the case of charitable or religious trusts:

- Every person in receipt of income derived from property held under charitable or religious trusts/legal obligations or in receipt of income being voluntary contributions referred to in section 2(24)(iia), has to file the return of income if its total income without giving effect to the provisions of sections 11 and 12 exceeds the maximum amount not chargeable to income-tax.

- [message]

- In the case of political parties:

- The Chief Executive Officer of every political party has to file the return of income of the party if the total income of the party without giving effect to the provisions of section 13A exceeds the maximum amount not chargeable to income-tax.

- [message]

- In the case of certain associations :

- Following entities are liable to file the return of income if their total income without giving effect to the provisions of section 10 exceeds the maximum amount not chargeable to tax:

- Research association referred to in section 10(21)

- News agency referred to in section 10(22B)

- Association or institution referred to in section 10(23A)

- Institution referred to in section 10(23B)

- Fund/institution/trust/university/other educational institution/any hospital/medical institution referred to in sub-clause (iiiad), (iiiae), (iv), (v), (vi) or (via) of section 10(23C)

- Mutual Fund referred to in clause (23D) of section 10

- Securitisation trust referred to in clause (23DA) of section 10

- Venture capital company or venture capital fund referred to in clause (23FB) of section 10;

- Trade union/association referred to in sub-clause (a) or (b) of section 10(24)

- Body/authority/Board/Trust/Commission referred to in section 10(46)

- Infrastructure debt fund referred to in section 10(47)

- [message]

- In the case of certain university, college or other institution:

- Every university, college or other institution referred to in clause (ii) and clause (iii) of section 35(1), which is not required to furnish return of income or loss under any other provision of the Act, shall furnish the return of income every year, irrespective of income (or) loss.

- [message]

- In the case of Business Trust

- Every business trust, which is not required to furnish return of income or loss under any other provision of the Act, shall furnish the return of income every year, irrespective of income (or) loss.

- [message]

- In case of investment fund referred to in section 115UB

- Every investment fund referred to in section 115UB, which is not required to furnish return of income or loss under any other provisions, shall furnish the return of income in respect of its income or loss every year irrespective of income (or) loss

- [message]

- In the case of persons holding assets located outside India:

- A person, being a resident in India (other than not ordinarily resident), who is not required to furnish a return under any of the above `and who at any time during the previous year :

(b) is a beneficiary (*) of any asset (including any financial interest in any entity) located outside India, shall furnish, on or before the due date, a return in respect of his income or loss for the previous year in such form and verified in such manner and setting forth such other particulars as may be prescribed. However, above discussed provision will not apply to an individual, being a beneficiary of any asset (including any financial interest in any entity) located outside India where, income, if any, arising from such asset is includible in the income of the person referred to in (a) above.

(*) "Beneficial owner" in respect of an asset means an individual who has provided, directly or indirectly, consideration for the asset for the immediate or future benefit, direct or indirect, of himself or any other person.

(*) "Beneficiary" in respect of an asset means an individual who derives benefit from the asset during the previous year and the consideration for such asset has been provided by any person other than such beneficiary.

(*) "Beneficial owner" in respect of an asset means an individual who has provided, directly or indirectly, consideration for the asset for the immediate or future benefit, direct or indirect, of himself or any other person.

(*) "Beneficiary" in respect of an asset means an individual who derives benefit from the asset during the previous year and the consideration for such asset has been provided by any person other than such beneficiary.

Due date of filing of return of income

Update : Due date for sr no 2,3,4 has been extended from

30.10.2017 to 07.11.2017

Illustration

Miss Rajni is a salaried employee. Her taxable salary income for the Financial year 2016-17 is Rs. 8,40,000 (she does not have any other income) . What will be the due date of filing the return of income for the financial year 2016-17?

In this case, Miss rajni will be covered in Sr. No. 5 of the table discussed earlier and hence the due date for filing the return of income of the year 2016-17 will be 31st July, 2017.

Illustration

Mr. Rupen is a doctor. Gross receipts for the year Financial 2016-17 came to Rs. 18,40,000. What will be the due date for filing of return of income by Mr. Rupen for the financial year 2016-17?

The gross receipts for the year are less than Rs. 50,00,000 and hence Mr. Rupen will not be liable to get his accounts audited i.e. he is not covered by audit. He will be covered in Sr. No. 5 of the table discussed earlier and, hence, the due date for filing the return of income of the year 2016-17 will be 31st July, 2017.

Illustration

Mr. Rahul is running a garments factory. Turnover of his business for the year 2016-17 amounted to Rs. 1,84,00,000. What will be the due date for filing of return of income by Mr. Rahul for the financial year 2016-17?

The turnover for the year is more than Rs. 1,00,00,000 and hence Mr. Rahul will be liable to get his accounts audited i.e. he is covered by audit. Mr. Rahul will be covered in Sr. No. 3 of the table discussed earlier and, hence, the due date of filing the return of income of the year 2016-17 will be 30th September, 2017.

Illustration

Mr. Kaushal is a partner in Essem Trading Company. The turnover of the firm for the financial year 2016-17 amounted to Rs. 1,84,00,000. Apart from remuneration, interest and share of profit from the firm, Mr. Kaushal is not having any other source of income. What will be the due date for filing the return of income by the partnership firm and by Mr. Kaushal for the financial year 2016-17?

The turnover of the firm exceeds Rs. 1,00,00,000 and, hence, the firm will be liable to get its accounts audited. Thus, the firm as well as Mr. Kaushal will be covered in Sr. No. 4 of the table discussed earlier and, hence, the due date for filing the return of income of the year 2016-17 (in case of the firm as well as Mr. Kaushal) will be 30th September, 2017.

Illustration

Mr. Kiran is a partner in SM Enterprises. The turnover of the firm for the financial year 2016-17 amounted to Rs. 84,00,000. The firm has declared income @ 8% on presumptive basis under section 44AD (6% for digital transactions)of the Act. Apart from remuneration, interest and share of profit from the firm, Mr. Kiran is not having any other source of income. What will be the due date of filing of return of income by the partnership firm and by Mr. Kiran for the financial year 2016-17?

The turnover of the firm is below Rs. 1,00,00,000 and, hence, it will not be liable to get its accounts audited. Thus, the firm as well as Mr. Kiran will be covered in Sr. No. 5 of the table discussed earlier and, hence, the due date for filing the return of income of the year 2016-17 (in case of firm as well as Mr. Kiran) will be 31st July, 2017.

Illustration

Essem Minerals Pvt. Ltd. is a company engaged in trading of minerals. What will be the due date for filing the return of income for the financial year 2016-17?

In this case Essem Ltd. will be covered in Sr. No. 2 of the table discussed earlier and, hence, the due date for filing the return of income of the year 2016-17 will be 30thSeptember, 2017.

Illustration

Essem Minerals Pvt. Ltd. is a company engaged in trading of minerals and liable to furnish a report in Form No. 3CEB under section 92E.What will be the due date for filing the return of income for the financial year 2016-17?

In this case Essem Ltd. will be covered in Sr. No. 2 of the table discussed earlier and, hence, the due date for filing the return of income of the year 2016-17 will be 30th November, 2017.

Wef assessment year 2017-18

Miss Rajni is a salaried employee. Her taxable salary income for the Financial year 2016-17 is Rs. 8,40,000 (she does not have any other income) . What will be the due date of filing the return of income for the financial year 2016-17?

In this case, Miss rajni will be covered in Sr. No. 5 of the table discussed earlier and hence the due date for filing the return of income of the year 2016-17 will be 31st July, 2017.

Illustration

Mr. Rupen is a doctor. Gross receipts for the year Financial 2016-17 came to Rs. 18,40,000. What will be the due date for filing of return of income by Mr. Rupen for the financial year 2016-17?

The gross receipts for the year are less than Rs. 50,00,000 and hence Mr. Rupen will not be liable to get his accounts audited i.e. he is not covered by audit. He will be covered in Sr. No. 5 of the table discussed earlier and, hence, the due date for filing the return of income of the year 2016-17 will be 31st July, 2017.

Illustration

Mr. Rahul is running a garments factory. Turnover of his business for the year 2016-17 amounted to Rs. 1,84,00,000. What will be the due date for filing of return of income by Mr. Rahul for the financial year 2016-17?

The turnover for the year is more than Rs. 1,00,00,000 and hence Mr. Rahul will be liable to get his accounts audited i.e. he is covered by audit. Mr. Rahul will be covered in Sr. No. 3 of the table discussed earlier and, hence, the due date of filing the return of income of the year 2016-17 will be 30th September, 2017.

Illustration

Mr. Kaushal is a partner in Essem Trading Company. The turnover of the firm for the financial year 2016-17 amounted to Rs. 1,84,00,000. Apart from remuneration, interest and share of profit from the firm, Mr. Kaushal is not having any other source of income. What will be the due date for filing the return of income by the partnership firm and by Mr. Kaushal for the financial year 2016-17?

The turnover of the firm exceeds Rs. 1,00,00,000 and, hence, the firm will be liable to get its accounts audited. Thus, the firm as well as Mr. Kaushal will be covered in Sr. No. 4 of the table discussed earlier and, hence, the due date for filing the return of income of the year 2016-17 (in case of the firm as well as Mr. Kaushal) will be 30th September, 2017.

Illustration

Mr. Kiran is a partner in SM Enterprises. The turnover of the firm for the financial year 2016-17 amounted to Rs. 84,00,000. The firm has declared income @ 8% on presumptive basis under section 44AD (6% for digital transactions)of the Act. Apart from remuneration, interest and share of profit from the firm, Mr. Kiran is not having any other source of income. What will be the due date of filing of return of income by the partnership firm and by Mr. Kiran for the financial year 2016-17?

The turnover of the firm is below Rs. 1,00,00,000 and, hence, it will not be liable to get its accounts audited. Thus, the firm as well as Mr. Kiran will be covered in Sr. No. 5 of the table discussed earlier and, hence, the due date for filing the return of income of the year 2016-17 (in case of firm as well as Mr. Kiran) will be 31st July, 2017.

Illustration

Essem Minerals Pvt. Ltd. is a company engaged in trading of minerals. What will be the due date for filing the return of income for the financial year 2016-17?

In this case Essem Ltd. will be covered in Sr. No. 2 of the table discussed earlier and, hence, the due date for filing the return of income of the year 2016-17 will be 30thSeptember, 2017.

Illustration

Essem Minerals Pvt. Ltd. is a company engaged in trading of minerals and liable to furnish a report in Form No. 3CEB under section 92E.What will be the due date for filing the return of income for the financial year 2016-17?

In this case Essem Ltd. will be covered in Sr. No. 2 of the table discussed earlier and, hence, the due date for filing the return of income of the year 2016-17 will be 30th November, 2017.

Belated return

Up to assessment year 2016-17

If the person fails to file the return of income within the time-limit prescribed in this regard, then as per section 139(4) he can file a belated return. Up to assessment year fy 2016-17 a belated return can be filed within one year from the end of the relevant assessment year or before completion of assessment, whichever is earlier.

For financial year 2015-16 (assessment year 2016-17) , belated return can be filed only up to 31.03.2018.

However, w.e.f. 01-04-2017, belated income-tax return for the Assessment Year 2017- 18 and onwards can be filed at any time before the end of the relevant assessment year or before the completion of the assessment, whichever is earlier.

For financial year 2016-17 (assessment year 2017-18) , belated return can be filed only up to 31.03.2018.

Illustration

Illustration

Mr. Rajiv is a trader of agricultural products. Turnover of his business for the previous year 2016-17 amounted to Rs. 84,00,000. He has not opted for the presumptive taxation scheme of section 44AD i.e. declaring income at 8% of sales(6% for digital transactions). What will be the ‘due date’ for filing his return of income for the financial year 2016-17? If he fails to file the return of income by the due date then by what date he can file a belated return?

In this case, as Mr. Rajiv had not opted for presumptive taxation scheme of section 44AD, if his income exceeds maximum exemption limit, he will be required to get his accounts audited under section 44AB and, hence, he is covered in Sr. No. 3 of the table discussed earlier. Hence, the due date for filing the return of income of the financial year 2016-17 will be 30th September, 2017.

If he cannot file the return of income by the due date, i.e., by 30th September, 2017, then he can file a belated return before end of the relevant assessment year or before completion of assessment, whichever is earlier.

In other words, he can file a belated return upto 31-3-2018. If the assessment is completed before 31-3-2018, then he can file a belated return at any time before the completion of assessment.

Revision of return

Up to assessment year 2016-17

A revised return can be filed within a period of one year from the end of the relevant assessment year or before completion of assessment, whichever is earlier.

Means returns of financial year 2015-16(assessment year 2016-17) can be revised up to 31.03.2018.

It should be noted that only a return filed under section 139(1) can be revised.A return of income filed pursuant to notice under section 142(1) of Act or belated return 139(4) cannot be revised under section 139(5).

A revised return can be filed within a period of one year from the end of the relevant assessment year or before completion of assessment, whichever is earlier.

It should however be noted that not only a return filed under section 139(1) but belated return filed under section 139(4) also can be revised.A return of income filed pursuant to notice under section 142(1) of Act cannot be revised under section 139(5).

Rule wef assessment year 2018-19(Revised Return can be filed within the end of assessment year)

A revised return can be filed within a period of up to end of the relevant assessment year or before completion of assessment, whichever is earlier.

- [message]

- Time limit for revisions of the income tax return filed by you

- Prior to the amendment of Section 139 by the Finance Act 2016, you were not allowed to revise your income tax return in case any mistake or error is noticed later on unless the same was filed before the due date applicable in your case. So now you could file your income tax return even if you had filed your original return after the due date within a period of one year from the end of the assessment year or completion of the assessment whichever is earlier. The Finance act 2017 has curtailed the time limit available with your for revising the income tax return by one year and now you are allowed to file your revised return by the end of the year only. So practically the time limit for filing and revising your original return remains the same. This will apply for the income tax returns to be filed for the assessment year 2018-2019. So for example you file your original return for the assessment year 2018-2019 on 31st March 2019 so you can not revise the revise the same beyond 31st March 2019 itself.

Consequences of Late filing the Income Tax Return

Loss can not be carried forward :Loss (other than loss under the head “Income from house property”) cannot be carried forward.

Certain exemption deduction not available :Exemptions/deductions under sections 10A, 10B, 80-IA, 80-IAB, 80-IB, 80-IC, 80-ID and 80-IE are not available.

Levy of interest under section 234A.:Interest Under section 234A @ 1 % per month applicable on Net outstanding Tax due amount .

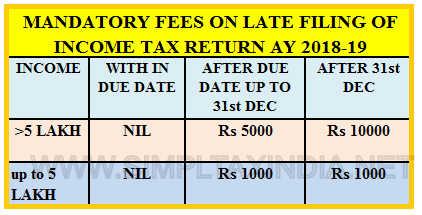

Late fee for Late fling of Income Tax return :Applicable from next year Ay 2018-19

Late fee Income tax return filing Assessment Year 18-19:

So in order to ensure that the taxpayers file their income tax returns by the due date which is generally 31st July for the average tax payers, Finance Act-2017 has levied a mandatory fee for such delay in filing of your income tax returns beyond the due dates. The finance minister has imposed a mandatory fee in case where you are required to file your income tax return under Section 139(1) due to the income being more than the taxable limit before allowing deductions under Chapter VIA and capital gains exemption under Section 10(38) of the income tax act. The amount of fee would depend on the quantum of delay and quantum of your income.

- [message]

- Mandatory fee Delay in Filing of Income Tax returns After Due Dates

- In case your income exceeds Rs. 5 lacs in a year you will have to pay a fee of Rs. 5000/- if you file your income tax return beyond 31st July(or due date applicable in you) but by 31st December of the assessment year.

- For filing the return of income beyond 31t December but by 31st March you will have to pay a fee of Rs. 10,000/-

- The amount of fee, however, would be restricted to Rs. 1,000/- in case your taxable income did not exceed Rs. 5 lakhs for the year.

- This mandatory fee has to be paid as self assessment before filing of the income tax return without having to wait for any communication from the assessing officer.

- It may be interesting to note that the fee is not payable in case your income does not exceed the basic exemption limit before giving the effect of deduction and exemption as explained above as your are not all at all required to file the return of income but are allowed to file the same.

- This will result into additional revenue for the government in the form of fee instead of penalty which did not bring any substantial revenue for the government.

Defective return

Section 139(9) provides the list of situations in which the return of income filed by the taxpayer can be treated as defective return. If the Assessing Officer finds the return of income to be defective under section 139(9), then he may intimate such defect to the taxpayer and may give an opportunity to him to rectify such defect.

The taxpayer shall rectify such defect in the return of income within a period of 15 days of such intimation or within such further period as the Assessing Officer may allow.

If the defect is not rectified within the period of 15 days or the further period so allowed (as the case may be), then, notwithstanding anything contained in any other provision of the Act, the return shall be treated as an invalid return and the provisions of the Act shall apply as if the taxpayer had failed to furnish the return.

A return of income shall be regarded as defective, unless all the following conditions are fulfilled:

- The annexures, statements and columns in the return of income relating to computation of income chargeable under each head of income, computation of gross total income and total income have been duly filled in.

- The return is accompanied by a statement showing the computation of the tax payable on the basis of the return.

- The return is accompanied by the report of the audit referred to in section 44AB, or, where the report has been furnished prior to the furnishing of the return, by a copy of such report together with proof of furnishing the report.

- The return is accompanied by proof of the tax, if any, claimed to have been deducted or collected at source and the advance tax and tax on self-assessment, if any, claimed to have been paid. Where the return is not accompanied by proof of the tax, if any, claimed to have been deducted or collected at source, the return of income shall not be regarded as defective if :

1. A certificate for tax deducted or collected was not furnished under section 203 or section 206C to the person furnishing his return of income.

2. Such certificate is produced within a period of two years specified under sub-section (14) of section 155.

- Where regular books of account are maintained by the taxpayer, the return is accompanied by copies of :

- 1. Manufacturing account, trading account, profit and loss account or, as the case may be, income and expenditure account or any other similar account and balance sheet.

- 2. In the case of a proprietary business or profession, the personal account of the proprietor; in the case of a firm, association of persons or body of individuals, personal accounts of the partners or members and in the case of a partner or member of a firm, association of persons or body of individuals, also his personal account in the firm, association of persons or body of individuals.

- Where the accounts of the taxpayer have been audited, the return is accompanied by copies of the audited profit and loss account and balance sheet and the auditor's report and, where an audit of cost accounts of the taxpayer has been conducted under section 233B of the Companies Act, 1956 [now Section 148 of Companies Act, 2013], also the report under that section.

- Where regular books of account are not maintained by the taxpayer, the return is accompanied by a statement indicating the amounts of turnover or, as the case may be, gross receipts, gross profit, expenses and net profit of the business or profession and the basis on which such amounts have been computed, and also disclosing the amounts of total sundry debtors, sundry creditors, stock-in-trade and cash balance as at the end of the previous year.

Note : As per the current norms prescribed by CBDT vide Income-tax Rules, 1962 for filing return of income, no documents shall be attached along with the Return of Income. Hence, documents like computation of income, balance sheet and accounts, audit report, TDS certificate, tax payment challan, proof of investment, etc., are not to be attached along with the return of income. No penalty will be levied for non-submission of these documents along with the return of income and the return will not be treated as defective due to non-attachment of aforesaid documents, statements, etc.

[next]

Return to be verified by whom

As per section 140, the return of income is to be verified by:

a) In the case of an individual :

- i. by the individual himself;

- ii. where he is absent from India, by the individual himself or by some person duly authorised by him in this behalf;

- iii. where he is mentally incapacitated from attending to his affairs, by his guardian or any other person competent to act on his behalf; and

- iv. where, for any other reason, it is not possible for the individual to verify the return, by any person duly authorised by him in this behalf:

It should be noted that in a case referred to in (ii) or (iv) above, the person verifying the return holds a valid power of attorney from the individual to do so, which shall be attached to the return.

b) in the case of a Hindu undivided family, by the karta, and, where the karta is absent from India or is mentally incapacitated from attending to his affairs, by any other adult member of such family;

c) in the case of a company, by the managing director thereof, or where for any unavoidable reason such managing director is not able to verify the return, or where there is no managing director, by any director thereof.

It should be noted that where the company is not resident in India, the return may be verified by a person who holds a valid power of attorney from such company to do so, which shall be attached to the return. Following points should be noted in this regard :

- (a) where the company is being wound up, whether under the orders of a court or otherwise, or where any person has been appointed as the receiver of any assets of the company, the return shall be verified by the liquidator referred to in section 178(1);

- (b) where the management of the company has been taken over by the Central Government or any State Government under any law, the return of the company shall be verified by the principal officer thereof;

- (cc) in the case of a firm, by the managing partner thereof, or where for any unavoidable reason such managing partner is not able to verify the return, or where there is no managing partner as such, by any partner thereof, not being a minor;

- (cd) in the case of a limited liability partnership, by the designated partner thereof, or where for any unavoidable reason such designated partner is not able to verify the return, or where there is no designated partner as such, by any partner thereof;

- (d) in the case of a local authority, by the principal officer thereof;

- (dd) in the case of a political party referred to in section 139(4B), by the chief executive officer of such party (whether such chief executive officer is known as secretary or by any other designation);

- (e) in the case of any other association, by any member of the association or the principal officer thereof; and

- (f) in the case of any other person, by that person or by some person competent to act on his behalf.

Filing the return through Tax Return Preparers

For the purpose of enabling any specified class or classes of persons (*) in preparing and furnishing returns of income, the Board has notified the Tax Return Preparers Scheme providing that such persons may furnish their returns of income through a Tax Return Preparer (TRP)* authorised to act as such under the Scheme

In other words, a specified person**can file his return of income through Government authorised return prepares i.e. TRPs.

*“Tax Return Preparer” means any individual, [not being a person referred to in section 288(2)(ii)/(iii)/(iv) or an employee of the “specified class or classes of persons”], who has been authorised to act as a Tax Return Preparer under the Scheme framed in this behalf.

**“Specified class or classes of persons” means any person, other than a company or a person, whose accounts are required to be audited under section 44AB or under any other law for the time being in force, who is required to furnish a return of income under the Act.

[next]

MCQ ON RETURN OF INCOME

Q1.Every person, being a company, has to file its return of income only if it has any positive income or if it wants to carry forward the loss (if any).

(a) True (b) False

Correct answer : (b) Justification of correct answer : Every person, being a company, has to file its return of income compulsorily, irrespective of its income being profit or loss. In other words, it is mandatory for every company to file the return of income irrespective of its income or loss.

Thus, the statement given in the question is false and hence, option (b) is the correct option.

Q2.Every person, being a partnership firm (including Limited Liability Partnership), has to file its return of income compulsorily, irrespective of its income being profit or loss.

(a) True (b) False

Correct answer : (a) Justification of correct answer :

Q1.Every person, being a company, has to file its return of income only if it has any positive income or if it wants to carry forward the loss (if any).

(a) True (b) False

Correct answer : (b) Justification of correct answer : Every person, being a company, has to file its return of income compulsorily, irrespective of its income being profit or loss. In other words, it is mandatory for every company to file the return of income irrespective of its income or loss.

Thus, the statement given in the question is false and hence, option (b) is the correct option.

Q2.Every person, being a partnership firm (including Limited Liability Partnership), has to file its return of income compulsorily, irrespective of its income being profit or loss.

(a) True (b) False

Correct answer : (a) Justification of correct answer :

Every person, being a partnership firm (including Limited Liability Partnership), has to file its return of income compulsorily, irrespective of its income being profit or loss. In other words, it is mandatory for every company to file the return of income irrespective of its income or loss. Thus, the statement given in the question is true and hence, option (a) is the correct option.

Q3.Every individual/HUF/AOP/BOI/artificial juridical person has to file the return of income if his total income (including income of any other person in respect of which he is assessable) without giving effect to the provisions of section 10(38), 10A, 10B or 10BA or Chapter VIA (i.e., deduction under section 80C to 80U), exceeds ________

(a) Rs. 2,00,000 (b) Rs. 2,50,000 (c)Rs. 5,00,000 (d) The maximum amount not chargeable to tax

Correct answer : (d) Justification of correct answer : Every individual/HUF/AOP/BOI/artificial juridical person has to file the return of income if his total income (including income of any other person in respect of which he is assessable) without giving effect to the provisions of section 10(38), 10A, 10B or 10BA or Chapter VIA (i.e., deduction under section 80C to 80U), exceeds the maximum amount not chargeable to tax i.e. exceeds the exemption limit. Thus, option (d) is the correct option.

Q4.Every person in receipt of income derived from property held under charitable or religious trusts/legal obligations or in receipt of income being voluntary contributions referred to in section 2(24)(iia), has to file the return of income if its total income after giving effect to the provisions of sections 11 and 12 exceeds the maximum amount not chargeable to income-tax.

(a) True (b) False

Correct answer : (b) Justification of correct answer : Every person in receipt of income derived from property held under charitable or religious trusts/legal obligations or in receipt of income being voluntary contributions referred to in section 2(24)(iia), has to file the return of income if its total income without giving effect to the provisions of sections 11 and 12 exceeds the maximum amount not chargeable to income-tax. Thus, the statement given in the question is false and hence, option (b) is the correct option.

Q5.The Chief Executive Officer of every political party has to file the return of income of the party if the total income of the party without giving effect to the provisions of section ____________ exceeds the maximum amount not chargeable to income-tax.

(a) 11 (b) 12 (c) 13 (d) 13A

Correct answer : (d) Justification of correct answer : The Chief Executive Officer of every political party has to file the return of income of the party if the total income of the party without giving effect to the provisions of section 13A exceeds the maximum amount not chargeable to income-tax. Thus, option (d) is the correct option.

Q6.What is the due date of filing the return of income in case of a company other than a company who is required to furnish a report in Form No. 3CEB under section 92E?

(a) September 30 of the assessment year (b) November 30 of the assessment the year (c) July 31 of the assessment year (d) June 30 of relevant assessment the year

Correct answer : (a) Justification of correct answer : The due date of filing the return of income in case of a company other than a company who is required to furnish a report in Form No. 3CEB under section 92E is September 30 of the assessment year. Thus, option (a) is the correct option.

Q7.What is the due date of filing the return of income in case of a person who is required to furnish a report in Form No. 3CEB under section 92E?

(a) September 30 of the assessment year (b) November 30 of the assessment the year (c) July 31 of the assessment year (d) June 30 of relevant assessment the year Correct answer : (b) Justification of correct answer : The due date of filing the return of income in case of a person who is required to furnish a report in Form No. 3CEB under section 92E is November 30 of the assessment year Thus, option (b) is the correct option.

Q8.What is the due date of filing the return of income in case of a person other than a company whose accounts are not required to be audited under the Income-tax Law or under any other law?

(a) September 30 of the assessment year (b) November 30 of the assessment the year (c) July 31 of the assessment year (d) June 30 of relevant assessment the year

Correct answer : (c) Justification of correct answer : The due date of filing the return of income in case of a person other than a company whose accounts are not required to be audited under the Income-tax Law or under any other law is July 31 of the assessment year. Thus, option (c) is the correct option.

Q9.What is the due date of filing the return of income in case of a person whose accounts are to be audited under the Income-tax Law or under any other law (other than a person who is required to furnish a report in Form No. 3CEB under section 92E)?

(a) September 30 of the assessment year (b) November 30 of the assessment the year (c) July 31 of the assessment year (d) June 30 of relevant assessment the year Correct answer : (a) Justification of

Q3.Every individual/HUF/AOP/BOI/artificial juridical person has to file the return of income if his total income (including income of any other person in respect of which he is assessable) without giving effect to the provisions of section 10(38), 10A, 10B or 10BA or Chapter VIA (i.e., deduction under section 80C to 80U), exceeds ________

(a) Rs. 2,00,000 (b) Rs. 2,50,000 (c)Rs. 5,00,000 (d) The maximum amount not chargeable to tax

Correct answer : (d) Justification of correct answer : Every individual/HUF/AOP/BOI/artificial juridical person has to file the return of income if his total income (including income of any other person in respect of which he is assessable) without giving effect to the provisions of section 10(38), 10A, 10B or 10BA or Chapter VIA (i.e., deduction under section 80C to 80U), exceeds the maximum amount not chargeable to tax i.e. exceeds the exemption limit. Thus, option (d) is the correct option.

Q4.Every person in receipt of income derived from property held under charitable or religious trusts/legal obligations or in receipt of income being voluntary contributions referred to in section 2(24)(iia), has to file the return of income if its total income after giving effect to the provisions of sections 11 and 12 exceeds the maximum amount not chargeable to income-tax.

(a) True (b) False

Correct answer : (b) Justification of correct answer : Every person in receipt of income derived from property held under charitable or religious trusts/legal obligations or in receipt of income being voluntary contributions referred to in section 2(24)(iia), has to file the return of income if its total income without giving effect to the provisions of sections 11 and 12 exceeds the maximum amount not chargeable to income-tax. Thus, the statement given in the question is false and hence, option (b) is the correct option.

Q5.The Chief Executive Officer of every political party has to file the return of income of the party if the total income of the party without giving effect to the provisions of section ____________ exceeds the maximum amount not chargeable to income-tax.

(a) 11 (b) 12 (c) 13 (d) 13A

Correct answer : (d) Justification of correct answer : The Chief Executive Officer of every political party has to file the return of income of the party if the total income of the party without giving effect to the provisions of section 13A exceeds the maximum amount not chargeable to income-tax. Thus, option (d) is the correct option.

Q6.What is the due date of filing the return of income in case of a company other than a company who is required to furnish a report in Form No. 3CEB under section 92E?

(a) September 30 of the assessment year (b) November 30 of the assessment the year (c) July 31 of the assessment year (d) June 30 of relevant assessment the year

Correct answer : (a) Justification of correct answer : The due date of filing the return of income in case of a company other than a company who is required to furnish a report in Form No. 3CEB under section 92E is September 30 of the assessment year. Thus, option (a) is the correct option.

Q7.What is the due date of filing the return of income in case of a person who is required to furnish a report in Form No. 3CEB under section 92E?

(a) September 30 of the assessment year (b) November 30 of the assessment the year (c) July 31 of the assessment year (d) June 30 of relevant assessment the year Correct answer : (b) Justification of correct answer : The due date of filing the return of income in case of a person who is required to furnish a report in Form No. 3CEB under section 92E is November 30 of the assessment year Thus, option (b) is the correct option.

Q8.What is the due date of filing the return of income in case of a person other than a company whose accounts are not required to be audited under the Income-tax Law or under any other law?

(a) September 30 of the assessment year (b) November 30 of the assessment the year (c) July 31 of the assessment year (d) June 30 of relevant assessment the year

Correct answer : (c) Justification of correct answer : The due date of filing the return of income in case of a person other than a company whose accounts are not required to be audited under the Income-tax Law or under any other law is July 31 of the assessment year. Thus, option (c) is the correct option.

Q9.What is the due date of filing the return of income in case of a person whose accounts are to be audited under the Income-tax Law or under any other law (other than a person who is required to furnish a report in Form No. 3CEB under section 92E)?

(a) September 30 of the assessment year (b) November 30 of the assessment the year (c) July 31 of the assessment year (d) June 30 of relevant assessment the year Correct answer : (a) Justification of

correct answer :The due date of filing the return of income in case of a person whose accounts are to be audited under the Income-tax Law or under any other law (other than a person who is required to furnish a report in Form No. 3CEB under section 92E) is September 30 of the assessment year.

Thus, option (a) is the correct option.

Q10.If a person fails to file the return of income within the time-limit prescribed in this regard, then as per section 139(4) he can file a belated return. A belated return can be filed within two year from the end of the relevant assessment year or before completion of assessment, whichever is earlier.

(a) True (b) False

Correct answer : (b) Justification of correct answer : If the person fails to file the return of income within the time-limit prescribed in this regard, then as per section 139(4) he can file a belated return. A belated return can be filed within one year from the end of the relevant assessment year or before completion of assessment, whichever is earlier. However, w.e.f. 01-04-2017, belated income-tax return for the Assessment Year 2017-18 and onwards can be filed at any time before the end of the relevant assessment year or before the completion of the assessment, whichever is earlier.

Thus, the statement given in the question is false and hence, option (b) is the correct option.

Thus, option (a) is the correct option.

Q10.If a person fails to file the return of income within the time-limit prescribed in this regard, then as per section 139(4) he can file a belated return. A belated return can be filed within two year from the end of the relevant assessment year or before completion of assessment, whichever is earlier.

(a) True (b) False

Correct answer : (b) Justification of correct answer : If the person fails to file the return of income within the time-limit prescribed in this regard, then as per section 139(4) he can file a belated return. A belated return can be filed within one year from the end of the relevant assessment year or before completion of assessment, whichever is earlier. However, w.e.f. 01-04-2017, belated income-tax return for the Assessment Year 2017-18 and onwards can be filed at any time before the end of the relevant assessment year or before the completion of the assessment, whichever is earlier.

Thus, the statement given in the question is false and hence, option (b) is the correct option.

[next]

Income Tax Return Due Date AY 2017-18

| ||

SN

|

Particulars

|

Due date

|

1

|

For assessees which is required to furnish a report u/s 92E(transfer pricing) of the Income Tax Act, 1961

|

30.11.2017

|

2

|

For all other Corporate assessees

| |

3

|

For Non corporate assessees, (Like Partnership Firm ,Prop Firm) whose accounts are required to be audited under Income tax act or any other act for the time being in force.

| |

4

|

For working partners of Partnership firms covered under sr no (3) above

| |

5

|

For any other assessees Like Salaried Income ,Person having Income from House property ,Interest income , Business Income where accounts are not required to be audited .

| |

BELATED RETURN -REVISED RETURN-LATE FEES ASSESSMENT YEARWISE

|

|||

PARTICULARS

|

ASSESSMENT YEAR

|

||

WWW.SIMPLETAXINDIA.NET

|

2016-17

|

2017-18

|

2018-19

|

LAST DATE TO FILE

BELATED RETURN

|

31.03.2018

|

31.03.2018

|

31.03.2019

|

LAST DATE TO FILE

REVISED RETURN

|

31.03.2018

|

31.03.2019

|

31.03.2019

|

BELATED RETURN CAN BE

REVISED

|

NO

|

YES

|

YES

|

LATE FEES APPLICABLE

|

NO

|

NO

|

YES

|

MANDATORY FEES ON LATE FILING OF INCOME TAX RETURN

| |||

INCOME

|

WITH IN DUE DATE UP TO 31st JULY

|

AFTER DUE DATE UP TO 31st DEC

|

AFTER 31st DEC

|

>5 LAKH

|

NIL

|

Rs 5000

|

Rs 10000

|

UP T0 5 LAKH

|

NIL

|

Rs 1000

|

Rs 1000

|

Tags:due date for filing of income tax return for ay 2017-18 last date of filing income tax return for ay 2017-18,last date of individual return filing,it return last date 2017 last date of filing income tax return fy 2017-18,personal income tax return due date,salary it return due date for 2017,income tax return deadline 2017 in india,income tax return pensioners 2017 due dates,when is the last date to filling of companies date .last date for filing itr return 2017-18,last date to file income tax return for individuals for a.y.2017-18

COMMENTS