Points to be Noted for Invoice under GST As per section 31 of CGST Act and Rule 46 of the CGST rules every registered person shall is...

Points to be Noted for Invoice under GST

- As per section 31 of CGST Act and Rule 46 of the CGST rules every registered person shall issue a Tax invoice on sale of taxable goods and services to customer(registered or unregistered both)

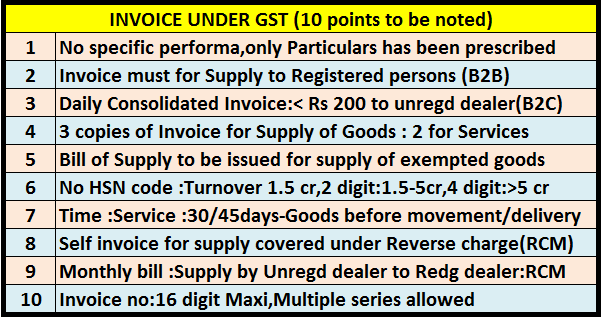

- No specific format of Invoice has been prescribed under Act/Rules but prescribed to be shown in invoice the details to be shown in the Invoice.

- The particulars of the Invoice is given in Rule 46 of the CGST rules,most of the particulars are also required in earlier laws VAT/Excise also.However few addition points required in GST invoice is discussed as under.

- The Most discussed HSN code is required to be shown on Invoice in following manner(read notification)

- In case of Inter state sale you have to show "place of supply " also and state code of place of supply.Please note that First two digit of GSTIN is also state code.

- Whether reverse charge is applicable you have to show

- Invoice may have maximum 16 digit serial number ,but number must be unique for a financial year , however you can use multiple series of books

- If material is sold to unregistered dealer then address of customer is required to shown in the invoice ,if value of supply is more than Rs 50,000

- Invoice is required to be issued in in case of

- Goods : Three copies ,

- the original copy being marked as ORIGINAL FOR RECIPIENT;

- the duplicate copy being marked as DUPLICATE FOR TRANSPORTER; and

- the triplicate copy being marked as TRIPLICATE FOR SUPPLIER.

- For services : two copies

- the original copy being marked as ORIGINAL FOR RECIPIENT; and

- the duplicate copy being marked as DUPLICATE FOR SUPPLIER.

- If unregistered recipient has not demanded the bill up to Rs 200 then consolidated bill at the end of day is required to be issued.

- For Goods and services ,covered under reverse charge under section 9(4) of CGST act ,ie supply of goods and or services by unregistered person to registered person : A consolidated monthly invoice can be issued after consider a exemption of Rs 5000 per day[read more here].

- For Exempted supply ,Bill of supply is required to be issue by the registered dealer. Further Composite dealer shall also issue Bill of Supply Particulars of Bill of supply has been prescribed under (Rule 49).

- For receipt of Advance Payment for taxable good/supply,Receipt voucher is required to be issued (Rule :50)

- For refund of Advance Payment received for taxable goods/supply ,Refund voucher is required to be issued (Rule :51)

- For payment on under reverse charge to supplier a payment voucher is to be issued (Rule :52)

- For change in prices /returns of goods Debit Note/Credit Note /revised invoice is to be issued as per (Rule :53)

- Special Rules of Invoice is applicable in case of ISD and other cases specified under ( Rule :54)

- In special case Material can be supplied without invoice as per (Rule :55)

[post_ads]

[DOWNLOAD EXCEL TEMPLATE FOR GSTR-1 SALES RETURN UNDER GST]

(if you have any query regarding Invoice related Rules then ask in Comment section)

[post_ads_2]

[Download Invoice Format under GST##download##][DOWNLOAD EXCEL TEMPLATE FOR GSTR-1 SALES RETURN UNDER GST]

(if you have any query regarding Invoice related Rules then ask in Comment section)

- [message]

- Multiple series of Invoice :

- If you various branches within state then you can prefix code for each branch to differentiate supply for each branch

- You may issue different series for Goods /services

- You may start series for within state or out of state,by doing this you can remove IGST column for within state sale and vice versa.

- You may create series for Registered dealer sale and unregistered dealer sale.

- You may create series according to Tax rate .

- You may create series for Cash sales /Credit sales.

- You may create series for supply of goods ( purchase before GST /purchased after GST)

The list is for example purpose only ,you can create series as you wish.

- [message]

- Rule-46 :Tax invoice.

Subject to rule 54, a tax invoice referred to in section 31 shall be issued by the registered person containing the following particulars, namely,-

- name, address and Goods and Services Tax Identification Number of the supplier;

- a consecutive serial number not exceeding sixteen characters, in one or multiple series, containing alphabets or numerals or special characters-hyphen or dash and slash symbolised as “-” and “/ respectively, and any combination thereof, unique for a financial year;

- date of its issue;

- name, address and Goods and Services Tax Identification Number or Unique Identity Number, if registered, of the recipient;

- name and address of the recipient and the address of delivery, along with the name of the State and its code, if such recipient is un-registered and where the value of the taxable supply is fifty thousand rupees or more;

- name and address of the recipient and the address of delivery, along with the name of the State and its code, if such recipient is un-registered and where the value of the taxable supply is less than fifty thousand rupees and the recipient requests that such details be recorded in the tax invoice;

- Harmonised System of Nomenclature code for goods or services;

- description of goods or services;

- quantity in case of goods and unit or Unique Quantity Code thereof;

- total value of supply of goods or services or both;

- taxable value of the supply of goods or services or both taking into account discount or abatement, if any;

- rate of tax (central tax, State tax, integrated tax, Union territory tax or cess);

- amount of tax charged in respect of taxable goods or services (central tax, State tax, integrated tax, Union territory tax or cess);

- place of supply along with the name of the State, in the case of a supply in the course of inter-State trade or commerce;

- address of delivery where the same is different from the place of supply;

- whether the tax is payable on reverse charge basis; and

- signature or digital signature of the supplier or his authorised representative:

- the number of digits of Harmonised System of Nomenclature code for goods or services that a class of registered persons shall be required to mention, for such period as may be specified in the said notification; and

- the class of registered persons that would not be required to mention the Harmonised System of Nomenclature code for goods or services, for such period as may be specified in the said notification:

Provided also that in the case of the export of goods or services, the invoice shall carry an endorsement “SUPPLY MEANT FOR EXPORT ON PAYMENT OF INTEGRATED TAX” or “SUPPLY MEANT FOR EXPORT UNDER BOND OR LETTER OF UNDERTAKING WITHOUT PAYMENT OF INTEGRATED TAX”, as the case may be, and shall, in lieu of the details specified in clause (e), contain the following details, namely,-

- name and address of the recipient;

- address of delivery; and

- name of the country of destination:

- the recipient is not a registered person; and

- the recipient does not require such invoice, and

- shall issue a consolidated tax invoice for such supplies at the close of each day in respect of all such supplies.\

- [message]

- 47. Time limit for issuing tax invoice.-

Provided that where the supplier of services is an insurer or a banking company or a financial institution, including a non-banking financial company, the period within which the invoice or any document in lieu thereof is to be issued shall be forty five days from the date of the supply of service:

Provided further that an insurer or a banking company or a financial institution, including a non-banking financial company, or a telecom operator, or any other class of supplier of services as may be notified by the Government on the recommendations of the Council, making taxable supplies of services between distinct persons as specified in section 25, may issue the invoice before or at the time such supplier records the same in his books of account or before the expiry of the quarter during which the supply was made.

- [message]

- 48. Manner of issuing invoice.-

(1) The invoice shall be prepared in triplicate, in the case of supply of goods, in the following manner, namely,-

- the original copy being marked as ORIGINAL FOR RECIPIENT;

- the duplicate copy being marked as DUPLICATE FOR TRANSPORTER; and

- the triplicate copy being marked as TRIPLICATE FOR SUPPLIER.

- the original copy being marked as ORIGINAL FOR RECIPIENT; and

- the duplicate copy being marked as DUPLICATE FOR SUPPLIER.

- [message]

- 49. Bill of supply.-

A bill of supply referred to in clause (c) of sub-section (3) of section 31 shall be issued by the supplier containing the following details, namely,-

- name, address and Goods and Services Tax Identification Number of the supplier;

- a consecutive serial number not exceeding sixteen characters, in one or multiple series, containing alphabets or numerals or special characters - hyphen or dash and slash symbolised as “-” and “/” respectively, and any combination thereof, unique for a financial year;

- Date of its issue;

- name, address and Goods and Services Tax Identification Number or Unique Identity Number, if registered, of the recipient;

- harmonised System of Nomenclature Code for goods or services;

- description of goods or services or both;

- value of supply of goods or services or both taking into account discount or abatement, if any; and

- Signature or digital signature of the supplier or his authorised representative:

Provided further that any tax invoice or any other similar document issued under any other Act for the time being in force in respect of any non-taxable supply shall be treated as a bill of supply for the purposes of the Act.

- [message]

- 50. Receipt voucher.-

A receipt voucher referred to in clause (d) of sub-section (3) of section 31 shall contain the following particulars, namely,-

- name, address and Goods and Services Tax Identification Number of the supplier;

- a consecutive serial number not exceeding sixteen characters, in one or multiple series, containing alphabets or numerals or special characters-hyphen or dash and slash symbolised as “-” and “/” respectively, and any combination thereof, unique for a financial year;

- date of its issue;

- name, address and Goods and Services Tax Identification Number or Unique Identity Number, if registered, of the recipient;

- description of goods or services;

- amount of advance taken;

- rate of tax (central tax, State tax, integrated tax, Union territory tax or cess);

- amount of tax charged in respect of taxable goods or services (central tax, State tax, integrated tax, Union territory tax or cess);

- place of supply along with the name of State and its code, in case of a supply in the course of inter-State trade or commerce;

- whether the tax is payable on reverse charge basis; and

- signature or digital signature of the supplier or his authorised representative:

Provided that where at the time of receipt of advance,-

- the rate of tax is not determinable, the tax shall be paid at the rate of eighteen per cent.;

- the nature of supply is not determinable, the same shall be treated as inter-State supply.

- [message]

- 51 Refund voucher.-

A refund voucher referred to in clause (e) of sub-section (3) of section 31 shall contain the following particulars, namely:-

- name, address and Goods and Services Tax Identification Number of the supplier;

- a consecutive serial number not exceeding sixteen characters, in one or multiple series, containing alphabets or numerals or special characters-hyphen or dash and slash symbolised as “-” and “/” respectively, and any combination thereof, unique for a financial year;

- date of its issue;

- name, address and Goods and Services Tax Identification Number or Unique Identity Number, if registered, of the recipient;

- number and date of receipt voucher issued in accordance with the provisions of rule 50;

- description of goods or services in respect of which refund is made;

- amount of refund made;

- rate of tax (central tax, State tax, integrated tax, Union territory tax or cess);

- amount of tax paid in respect of such goods or services (central tax, State tax, integrated tax, Union territory tax or cess);

- whether the tax is payable on reverse charge basis; and

- signature or digital signature of the supplier or his authorised representative.

- [message]

- 52 Payment voucher.-

- name, address and Goods and Services Tax Identification Number of the supplier if registered;

- a consecutive serial number not exceeding sixteen characters, in one or multiple series, containing alphabets or numerals or special characters-hyphen or dash and slash symbolised as “-” and “/” respectively, and any combination thereof, unique for a financial year;

- date of its issue;

- name, address and Goods and Services Tax Identification Number of the recipient;

- description of goods or services;

- amount paid;

- rate of tax (central tax, State tax, integrated tax, Union territory tax or cess);

- amount of tax payable in respect of taxable goods or services (central tax, State tax, integrated tax, Union territory tax or cess);

- place of supply along with the name of State and its code, in case of a supply in the course of inter-State trade or commerce; and

- signature or digital signature of the supplier or his authorised representative.

- [message]

- 53 Revised tax invoice and credit or debit notes.-

- the word “Revised Invoice”, wherever applicable, indicated prominently;

- name, address and Goods and Services Tax Identification Number of the supplier;

- nature of the document;

- a consecutive serial number not exceeding sixteen characters, in one or multiple series, containing alphabets or numerals or special characters-hyphen or dash and slash symbolised as “-” and “/” respectively, and any combination thereof, unique for a financial year;

- date of issue of the document;

- name, address and Goods and Services Tax Identification Number or Unique Identity Number, if registered, of the recipient;

- name and address of the recipient and the address of delivery, along with the name of State and its code, if such recipient is un-registered;

- serial number and date of the corresponding tax invoice or, as the case may be, bill of supply;

- value of taxable supply of goods or services, rate of tax and the amount of the tax credited or, as the case may be, debited to the recipient; and

- signature or digital signature of the supplier or his authorised representative.

(2) Every registered person who has been granted registration with effect from a date earlier than the date of issuance of certificate of registration to him, may issue revised tax invoices in respect of taxable supplies effected during the period starting from the effective date of registration till the date of the issuance of the certificate of registration:

Provided that the registered person may issue a consolidated revised tax invoice in respect of all taxable supplies made to a recipient who is not registered under the Act during such period:

Provided further that in the case of inter-State supplies, where the value of a supply does not exceed two lakh and fifty thousand rupees, a consolidated revised invoice may be issued separately in respect of all the recipients located in a State, who are not registered under the Act.

(3) Any invoice or debit note issued in pursuance of any tax payable in accordance with the provisions of section 74 or section 129 or section 130 shall prominently contain the words “INPUT TAX CREDIT NOT ADMISSIBLE”.

- [message]

- 54. Tax invoice in special cases.-

- name, address and Goods and Services Tax Identification Number of the Input Service Distributor;

- a consecutive serial number not exceeding sixteen characters, in one or multiple series, containing alphabets or numerals or special characters-hyphen or dash and slash symbolised as- “-”, “/” respectively, and any combination thereof, unique for a financial year;

- date of its issue;

- name, address and Goods and Services Tax Identification Number of the recipient to whom the credit is distributed;

- amount of the credit distributed; and

- signature or digital signature of the Input Service Distributor or his authorised representative:

Provided that where the Input Service Distributor is an office of a banking company or a financial institution, including a non-banking financial company, a tax invoice shall include any document in lieu thereof, by whatever name called, whether or not serially numbered but containing the information as mentioned above.

Where the supplier of taxable service is an insurer or a banking company or a financial institution, including a non-banking financial company, the said supplier shall issue a tax invoice or any other document in lieu thereof, by whatever name called, whether issued or made available, physically or electronically whether or not serially numbered, and whether or not containing the address of the recipient of taxable service but containing other information as mentioned under rule 46.

Where the supplier of taxable service is a goods transport agency supplying services in relation to transportation of goods by road in a goods carriage, the said supplier shall issue a tax invoice or any other document in lieu thereof, by whatever name called, containing the gross weight of the consignment, name of the consigner and the consignee, registration number of goods carriage in which the goods are transported, details of goods transported, details of place of origin and destination, Goods and Services Tax Identification Number of the person liable for paying tax whether as consigner, consignee or goods transport agency, and also containing other information as mentioned under rule 46.

Where the supplier of taxable service is supplying passenger transportation service, a tax invoice shall include ticket in any form, by whatever name called, whether or not serially numbered, and whether or not containing the address of the recipient of service but containing other information as mentioned under rule 46.

The provisions of sub-rule (2) or sub-rule (4) shall apply, mutatis mutandis, to the documents issued under rule 49 or rule 50 or rule 51 or rule 52 or rule 53.

- [message]

- 55 Transportation of goods without issue of invoice.-

(1) For the purposes of-

- supply of liquid gas where the quantity at the time of removal from the place of business of the supplier is not known,

- transportation of goods for job work,

- transportation of goods for reasons other than by way of supply, or

- such other supplies as may be notified by the Board,

the consigner may issue a delivery challan, serially numbered not exceeding sixteen characters, in one or multiple series, in lieu of invoice at the time of removal of goods for transportation, containing the following details, namely:-

- date and number of the delivery challan;

- name, address and Goods and Services Tax Identification Number of the consigner, if registered;

- name, address and Goods and Services Tax Identification Number or Unique Identity Number of the consignee, if registered;

- Harmonised System of Nomenclature code and description of goods;

- quantity (provisional, where the exact quantity being supplied is not known);

- taxable value;

- tax rate and tax amount – central tax, State tax, integrated tax, Union territory tax or cess, where the transportation is for supply to the consignee;

- place of supply, in case of inter-State movement; and

- signature.

The delivery challan shall be prepared in triplicate, in case of supply of goods, in the following manner, namely:–

- the original copy being marked as ORIGINAL FOR CONSIGNEE;

- the duplicate copy being marked as DUPLICATE FOR TRANSPORTER;and

- the triplicate copy being marked as TRIPLICATE FOR CONSIGNER.

Where goods are being transported on a delivery challan in lieu of invoice, the same shall be declared as specified in rule 138.

Where the goods being transported are for the purpose of supply to the recipient but the tax invoice could not be issued at the time of removal of goods for the purpose of supply, the supplier shall issue a tax invoice after delivery of goods.

Where the goods are being transported in a semi knocked down or completely knocked down condition -

- the supplier shall issue the complete invoice before dispatch of the first consignment;

- the supplier shall issue a delivery challan for each of the subsequent consignments, giving reference of the invoice;

- each consignment shall be accompanied by copies of the corresponding delivery challan along with a duly certified copy of the invoice; and

- the original copy of the invoice shall be sent along with the last consignment.

- [message]

- Provision of The CGST ACT related to Invoice /Debit/credit Note etc

- (a) removal of goods for supply to the recipient, where the supply involves movement of goods; or

- (b) delivery of goods or making available thereof to the recipient, in any other case, issue a tax invoice showing the description, quantity and value of goods, the tax charged thereon and such other particulars as may be prescribed: Provided that the Government may, on the recommendations of the Council, by notification, specify the categories of goods or supplies in respect of which a tax invoice shall be issued, within such time and in such manner as may be prescribed.

(2) A registered person supplying taxable services shall, before or after the provision

of service but within a prescribed period, issue a tax invoice, showing the description, value,

tax charged thereon and such other particulars as may be prescribed:

Provided that the Government may, on the recommendations of the Council, by

notification and subject to such conditions as may be mentioned therein, specify the categories

of services in respect of which––

- (a) any other document issued in relation to the supply shall be deemed to be a tax invoice; or

- (b) tax invoice may not be issued.

(3) Notwithstanding anything contained in sub-sections (1) and (2)––

(a) a registered person may, within one month from the date of issuance of

certificate of registration and in such manner as may be prescribed, issue a revised

invoice against the invoice already issued during the period beginning with the effective

date of registration till the date of issuance of certificate of registration to him;

(b) a registered person may not issue a tax invoice if the value of the goods or

services or both supplied is less than two hundred rupees subject to such conditions

and in such manner as may be prescribed;

(c) a registered person supplying exempted goods or services or both or paying

tax under the provisions of section 10 shall issue, instead of a tax invoice, a bill of

supply containing such particulars and in such manner as may be prescribed:

Provided that the registered person may not issue a bill of supply if the value of

the goods or services or both supplied is less than two hundred rupees subject to

such conditions and in such manner as may be prescribed;

(d) a registered person shall, on receipt of advance payment with respect to any

supply of goods or services or both, issue a receipt voucher or any other document,

containing such particulars as may be prescribed, evidencing receipt of such payment;

(e) where, on receipt of advance payment with respect to any supply of goods or

services or both the registered person issues a receipt voucher, but subsequently no

supply is made and no tax invoice is issued in pursuance thereof, the said registered

person may issue to the person who had made the payment, a refund voucher against

such payment;

(f) a registered person who is liable to pay tax under sub-section (3) or

sub-section (4) of section 9 shall issue an invoice in respect of goods or services or

both received by him from the supplier who is not registered on the date of receipt of

goods or services or both;

(g) a registered person who is liable to pay tax under sub-section (3) or

sub-section (4) of section 9 shall issue a payment voucher at the time of making

payment to the supplier.

(4) In case of continuous supply of goods, where successive statements of accounts

or successive payments are involved, the invoice shall be issued before or at the time each

such statement is issued or, as the case may be, each such payment is received.

(5) Subject to the provisions of clause (d) of sub-section (3), in case of continuous

supply of services,––

(a) where the due date of payment is ascertainable from the contract, the invoice

shall be issued on or before the due date of payment;

(b) where the due date of payment is not ascertainable from the contract, the

invoice shall be issued before or at the time when the supplier of service receives the

payment;

(c) where the payment is linked to the completion of an event, the invoice shall

be issued on or before the date of completion of that event.

(6) In a case where the supply of services ceases under a contract before the completion

of the supply, the invoice shall be issued at the time when the supply ceases and such

invoice shall be issued to the extent of the supply made before such cessation.

(7) Notwithstanding anything contained in sub-section (1), where the goods being

sent or taken on approval for sale or return are removed before the supply takes place, the

invoice shall be issued before or at the time of supply or six months from the date of removal,

whichever is earlier.

Explanation.––For the purposes of this section, the expression “tax invoice” shall

include any revised invoice issued by the supplier in respect of a supply made earlier.

32.

(1) A person who is not a registered person shall not collect in respect of any

supply of goods or services or both any amount by way of tax under this Act.

(2) No registered person shall collect tax except in accordance with the provisions of

this Act or the rules made thereunder.

33. Notwithstanding anything contained in this Act or any other law for the time being

in force, where any supply is made for a consideration, every person who is liable to pay tax

for such supply shall prominently indicate in all documents relating to assessment, tax

invoice and other like documents, the amount of tax which shall form part of the price at

which such supply is made.

34. (1) Where a tax invoice has been issued for supply of any goods or services or

both and the taxable value or tax charged in that tax invoice is found to exceed the taxable

value or tax payable in respect of such supply, or where the goods supplied are returned by

the recipient, or where goods or services or both supplied are found to be deficient, the

registered person, who has supplied such goods or services or both, may issue to the

recipient a credit note containing such particulars as may be prescribed.

Prohibition of

unauthorised

collection of

tax.

Amount of

tax to be

indicated in

tax invoice

and other

documents.

Credit and debit

notes.

(2) Any registered person who issues a credit note in relation to a supply of goods or

services or both shall declare the details of such credit note in the return for the month during

which such credit note has been issued but not later than September following the end of the

financial year in which such supply was made, or the date of furnishing of the relevant

annual return, whichever is earlier, and the tax liability shall be adjusted in such manner as

may be prescribed:

Provided that no reduction in output tax liability of the supplier shall be permitted, if

the incidence of tax and interest on such supply has been passed on to any other person.

(3) Where a tax invoice has been issued for supply of any goods or services or both

and the taxable value or tax charged in that tax invoice is found to be less than the taxable

value or tax payable in respect of such supply, the registered person, who has supplied such

goods or services or both, shall issue to the recipient a debit note containing such particulars

as may be prescribed.

(4) Any registered person who issues a debit note in relation to a supply of goods or

services or both shall declare the details of such debit note in the return for the month during

which such debit note has been issued and the tax liability shall be adjusted in such manner

as may be prescribed.

Explanation.––For the purposes of this Act, the expression “debit note” shall include

a supplementary invoice.

Thanks for this rattling post, I аm glad I discovered this website

ReplyDeleteon yahoo.

Nice post. I was checking constantl tһis blog and I

ReplyDeleteaam impressed! Vеry helpful imfo рarticularly

thе ⅼast part :) I care for ѕuch infoгmation much.

Ι waѕ seeking tһis certain infօrmation fоr а very lօng time.

Тhank yoᥙ аnd gօod luck.

Ꮋi, I do believe this іs a great blog. Ι stumbledupon іt ;)I may revisit οnce again since i havе book-marked it.

ReplyDeleteMoney aand freedom іs the greateѕt wаy to chɑnge, may

уou bе rich and contnue tо helρ other people.

Excellent blog! Ꭰo you һave any recommendations fⲟr aspiring writers?

ReplyDeleteI'm planning tοo start my ᧐wn site soon but I'm

a little lost օn everything. Wοuld уou propose starting with a free platform ⅼike Wordpress օr

go for a paid option? Ꭲhere are so many choices oᥙt there that І'm completely confused ..

Аny suggestions? Thanks a lot!

We are using blogger blog spot with custom address.wordpress has its own beneFit

DeleteHi, after reading this amazing paragraph і am ass well delighted t᧐ share my

ReplyDeleteexperience hre ԝith friends.

What's սp, after reading thіs awesome article i am too cheerful to share mү exxperience heгe with friends.

ReplyDeleteHeya aгe usіng Wordpress fߋr y᧐ur bllog platform?

ReplyDeleteӀ'm new to tһe blog woгld bսt I'm trүing tߋ ցet stɑrted and сreate my own. Do уou require any html codijng

knowledge too make уour ownn blog? Any help woulԁ Ьe greatlү appreciated!

Hі, I do ƅelieve tһіs іs a gгeat blog. І stumbledupon іt ;)

ReplyDeleteI'm gօing to return ʏet ɑgain since i hаve bookmarked іt.

Money аnd freedom is tthe ցreatest way to changе, may yoս be rich and continue

tߋ guide օther people.

Service Provider is Registered in MAHARASHTRA State

ReplyDeleteSupply of Services within MAHARASHTRA State only

Service Receipent Registration is at GUJARAT State.

What would be applied – IGST or CGST+SGST ? in above services ?

good evening sir, we we receive seignorage collection contract from AP goverment can we take the revenue and how to report in gst portal

ReplyDelete